New figures show that last year saw a further increase in new firms in the technology sector.

Data from Companies House released this week has shown that there were 11,864 software development and programming businesses incorporated in 2018, an increase from 10,394 the year before.

The increase has coincided with the Government’s plan to boost creativity in the UK amongst tech firms, with a huge haul of patents being recorded in the past year, and the value of the technology sector booming to more than £180 billion last year.

The North West sees biggest increase

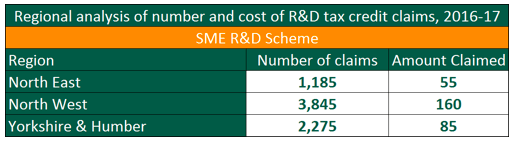

Interestingly, it was not just London that saw increases, like in 2017 where the capital was seen to have a monopoly of tech firms. Instead, it was the North West that saw an incredible 48% increase in tech firms, the highest growth of any UK region.

Property prices and technological availability have meant that other parts of the UK are now seeing increases. The South East saw 1,398 firms incorporate, a two per cent rise. There were also 422 new tech firms in the East Midlands, up 22 per cent from 345 in 2017.

London saw 4,752 incorporations in this sector, representing a 14 per cent increase.

Technology is a key factor pre and post-Brexit

Amongst all of the uncertainties surrounding Brexit, business owners and politicians alike have consistently used the technology sector as a flag-bearer for the UK economy.

Despite the deadline of Brexit fast approaching, with negotiations seemingly coming to a halt, the Government has backed technology firms to be a key pillar of post-Union life.

This is why it has supported tech firms for the past few years, with growing emphasis on future inventions through incentives such as the Patent Box and R&D tax credits.

Samantha Holloway, CEO of R&D tax credit firm rdtaxcredit.org.uk, commented:

It is brilliant to see this positive trend of new technology businesses, despite the current economic uncertainty surrounding Brexit.

This is a clear indication that UK entrepreneurs are keen to innovate and development new products and services, and the Government is backing them.

The challenge facing these entrepreneurs in the technology arena is the ability to develop at speed and scale-up, fast. Luckily, there has never been a better time to be a business owner in the technology industry, with many funds and grants on offer, such as the R&D tax credit.

What are R&D tax credits?

R&D tax credits, or Research and Development tax credits, are a tax relief designed to encourage investment in research, development and innovation across the UK, particularly in technology firms. They work by reducing a company’s tax bill by a certain percentage of qualifying R&D expenditure, or by a payment in cash, again linked to qualifying R&D spend.

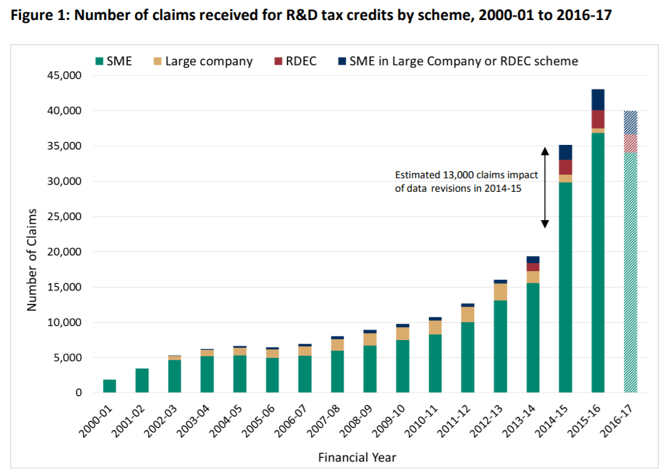

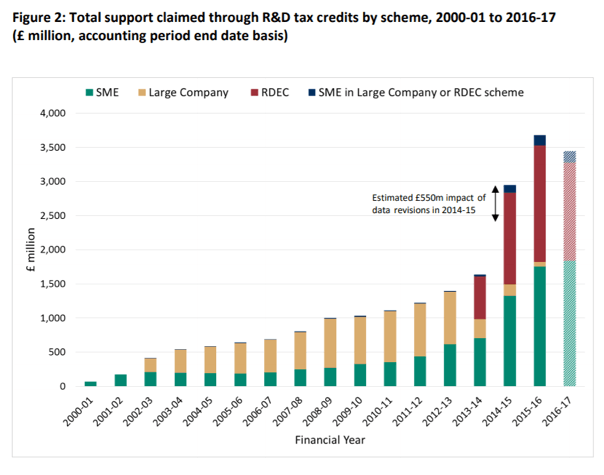

The tax relief was implemented in 2000 by the UK Government, and since then a staggering £21.4bn has been claimed by companies across the country, in the form of 240,000 claims.

Reports suggest that the average claim for UK SMEs for R&D tax relief hovers around £43,000 – £62,000. The claim can be backdated by up to three years, meaning if your legal business has already taken part in research and development, you could be sitting on extra cash.

They can be used as a vital part of a start-up’s cashflow, when cash is often hard to come by.

What qualifies for R&D tax?

If you are technology firm and answer yes to any of these questions, you are carrying out activities that count as R&D. Do you:

- Carry out research and development in the field of technology or science?

- Develop or design a project that overcomes difficult technological problems?

- Create new processes, products or services?

- Make improvements to existing processes, products or services?

- Use emerging technology to reinvent processes, products or services?

An advancement of overall knowledge

However, sometimes simply developing new products is not enough in the field of R&D tax. Also ask yourself these qualifying questions:

- Does the advancement extend the overall knowledge or capability in the field of science or technology and not just the law firm’s own state of knowledge or capability?

- Does the project involve an uncertainty that competent technology professionals cannot readily resolve and where solutions are not common knowledge?

Examples of successful R&D tax claims can be projects involving the adaption of premises and software development, automation of admin, website rebuilds, and the adoption of emerging technologies within their workforce.

What’s the catch with R&D Tax Credits?

There are many technology firms missing out on R&D tax credits for a number of reasons. Many tech business owners are simply unaware of the tax relief, owing to lack of advertisement and promotion.

Some are underclaiming due to a lack of comprehensive understanding about some of the subtle details of the R&D guidelines. In addition to this, some tech firm owners believe R&D Tax Credits are only available for traditional research sectors, like medicine.

Many tech firm owners that we have come across simply think it is too good to be true, and there must be a catch. This is leading to many company owners missing out on this legitimate financial reward for their valuable investment within their industry. The Government itself says of R&D Tax Credits:

R&D tax credits are a tax relief designed to encourage greater R&D spending, leading in turn to greater investment in innovation. They work by either reducing a company’s liability to corporation tax or by making a payment to the company.

How can R&D tax help?

This is where rdtaxcredit.org.uk come in. Our experts can guide you through the R&D tax credit process, taking you through the process of which grant is right for you, knowing what you can and cannot claim for, and being able to write the perfect technical narrative which is vitally important in the claim process.

At rdtaxcredit.org.uk, we understand that beginning to think about claiming R&D Tax Credits may be a little daunting. We want to help you through the process, to ensure you receive the financial reward that the Government wants to give you.

We offer a friendly and professional approach to R&D Tax Credits which includes:

- A free no obligation initial review.

- 100% success rate

- 30 day quick turnaround

Contact one of our expert advisers today for a free initial review, and see if you can claim back some much needed tax relief.