Ensure your company gets the best start by taking advantage of this government incentive.

Starting a business is one of the most exciting and exhilarating times in your life. Your business is your brainchild with all your efforts going into nurturing your ideas. It also takes a huge amount of courage and commitment to finally take the plunge into the start-up world.

Much of the planning of setting up your business will have been centred around branding, how the business will operate, what the website will look like, but not much thought will go into what the government can offer you as incentives. For some start-ups, the notion of R&D tax credits does not even cross their mind.

We are giving you the opportunity to learn about R&D tax credits so that your business gets the best possible head-start. With this government tax relief, you can give your new company a much needed boost.

Why does my start-up need R&D Tax Credits?

We don’t mean to scare you if you have just set up a company, but the fact remains that studies from Company House show 8 out of 10 start-ups fail within their first year. While the UK has become a hub of entrepreneurial spirit and flair, many companies find it tough in their first year due to underestimating competition and, crucially, a lack of financial planning.

One of the reasons start-ups run out of steam is running out cash. A key job of the business owner is properly prepare the business financially, to lead to a positive cash flow.

In a start-up it is fairly easy to focus on driving revenue and looking at profits, while ignoring the implications of insufficient cash resources. Cash flow management is crucial in ensuring employees and third-party suppliers can be paid, ensuring operations can continue undisturbed.

There is also a lot to think about when running a start-up. Hiring staff, buying supplies, working out the dynamics of your team, looking out for competitors. With all of this going on, R&D tax relief can seem like a bridge too far for many. Many entrepreneurs believe it is something to come back to when their business is further down the link. This is wrong, as R&D tax credits can get start-ups through that initial cash-flow rocky road.

What are R&D Tax Credits?

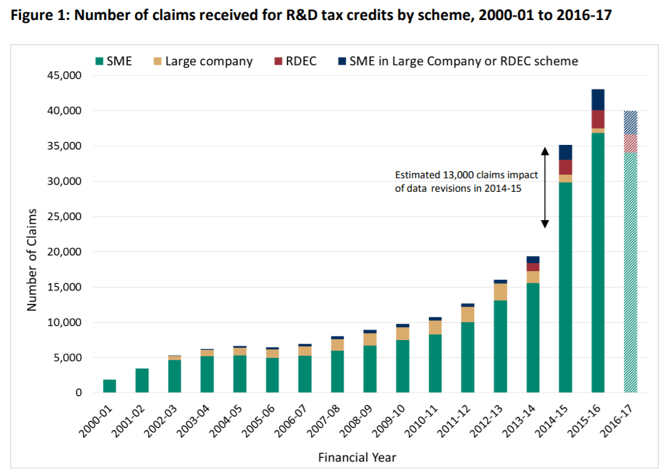

R&D tax credits, or research and development tax credits, were created in 2000 by the UK government to help small and medium enterprises (SMES) invest in innovation. This is due to the UK government wanting businesses to flourish and compete on a global scale.

Paired with special funding, grants, and various other hand-outs, R&D tax credits now help small businesses like yours put money into experimentation, research and development, without having to worry about the cost of any losses.

The relief works by either reducing a company’s liability to corporation tax or by making a direct payment to the company.

The research and development has to be focussed on advancing industry level knowledge. If the research could be carried out by a reasonably competent professional in that particular field, you may have trouble convincing HMRC of the validity of the claim.

This may sound like a difficult task. However, we have learnt through experience to teach SMEs and start-ups to never assume the work you are doing doesn’t qualify for the tax relief. Always ask a tax relief expert, as they may be able to identify some part of what you are doing that can attract help.

How much are R&D Tax Credits worth to my start-up?

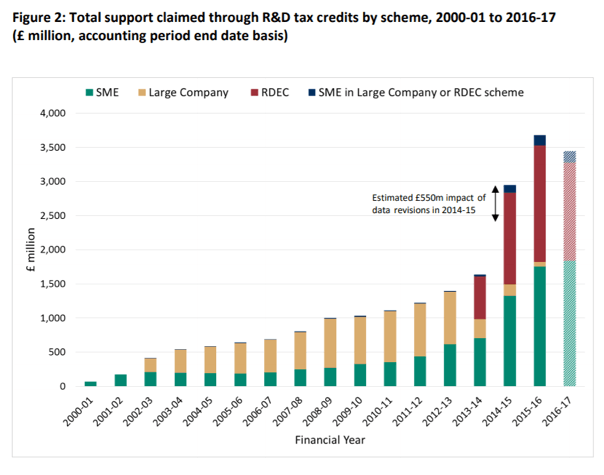

A staggering £21.4bn has been claimed in tax relief since 2000, in the form of 240,000 claims.

Most start-ups would come under the SME R&D tax relief scheme. This means relief for start-ups can be as much as 230% of qualifying R&D costs if you are a small or medium sized enterprise. You can claim R&D tax credits on day-to-day costs and qualifying expenditure, including costs for staff, subcontractors, materials, software and utilities.

Even if your start-up is loss making, you can claim 14.5% of the loss as a tax credit. This equates to up to 33p for every £1 spent on R&D as a cash payment from HMRC. No start-up doing R&D work that might qualify can afford to ignore that sort of assistance.

In addition to this, and crucially, the work done on research and development does not actually have to be successful to qualify.

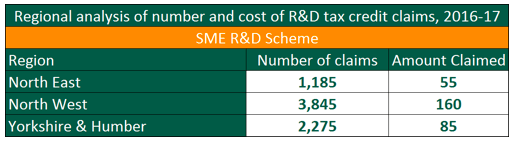

For 2016-17, £3.7bn was claimed by SMEs up and down the country, at an average of £53,000 per claim.

How can RDTaxCredit.org.uk help?

RDTaxCredit.org.uk help companies across all sectors with claiming R&D relief, leaving them with more cash to re-invest into their business. We have of experience in dealing with many start-ups across the UK.

CEO of rdtaxcredit.org.uk, Samantha Holloway, said:

Entrepreneurs and owners of start-ups expect to work hard for funding, so they can initially be sceptical about this benefit. They think it is too good to be true.

However, R&D tax credits are a legitimate government program that rewards investments in innovation. It is a benefit every start-up needs to know about.

Our Team of Chartered Tax Advisers ensure you have a robust claim that identifies qualifying R&D and the associated costs.

We can assist in preparation of the R&D claims and submission of the claim to HM Revenue & Customs.

We handle the R&D Claim from start to finish & we produce the technical report on your behalf that helps R&D Tax inspectors understand your work and approve the claim

At rdtaxcredit.org.uk, we understand that beginning to think about claiming R&D Tax Credits may be a little daunting. We want to help you through the process, to ensure you receive the financial reward that the Government wants to give you.

We offer a friendly and professional approach to R&D Tax Credits which includes:

- A free no obligation initial review.

- 100% success rate

- 30 day quick turnaround

If you would like to contact one of our experts for free initial advice, complete the quick enquiry form to receive a no-obligation review of your R & D Tax Relief claim.